- Home

- Investors

- Governance documents

- Whistleblowing policy

- Investors

- Calendar

- ASX Announcements

- Results & reports

- Board of Directors

- Share information & registry

- Corporate directory

- AGM

-

Governance documents

- Anti bribery & corruption policy

- Audit & risk committee charter

- Board charter

- Code of ethics & conduct policy

- Conflicts of interests policy

- Disclosure & communication policy

- Diversity policy

- Gender diversity

- Modern slavery act statement

- People & performance committee charter

- Share trading policy

- Whistleblowing policy

- Anti-Fraud and Fraud Awareness Policy

- Supplier Code of Ethics

Overview

1. Application

This policy applies to all employees of the Iress group (Iress) including part-time and casual employees, officers, agency workers, contractors and suppliers and their employees (where relevant) and is subject to applicable laws as they apply to the local Iress entity. A copy of this policy is available on Iress’ website.

2. Purpose

This policy details how people may report any instances they identify in the workplace which they have reasonable grounds to suspect represent inappropriate, unethical, illegal or fraudulent conduct (Reportable Conduct). The aims of this policy are:

a) to encourage people to report any suspected Reportable Conduct as soon as possible, with the knowledge that their concerns will be taken seriously, appropriately investigated, and that their confidentiality will be respected;

b) to provide people with guidance as to how to raise those concerns; and

c) to reassure people that they can raise any concerns and complaints of Reportable Conduct without fear of discrimination, intimidation, disadvantage or reprisal.

This policy does not form part of any contract of employment. The policy can be amended or varied by Iress at any time. Nothing in this policy is intended to change or take away any other protections which may be available at law. It is the intention that this policy applies to all Iress entities globally. If there is inconsistency between this policy and the provision of relevant local laws, the provisions of the relevant local laws will apply to the extent of the inconsistency.

3. Responsibilities for all those covered by this policy

Each person covered by this policy is in a position of trust and must support the reporting of Reportable Conduct under this policy and adhere to appropriate standards of behaviour that are both legal and ethical in accordance with Iress’s policies and applicable local laws.

Iress does not tolerate anyone being discouraged from reporting Reportable Conduct under this policy or being subject to detriment because they have made a report or intend to do so. Disciplinary action as Iress deems appropriate may be taken in respect of anyone shown to have caused detriment to a person in connection with reporting Reportable Conduct under this policy.

4. What must a Whistleblower report be about?

What is Reportable Conduct?

While it is not possible to provide an exhaustive list of the activities which should be reported for the purpose of this policy, generally to provide guidance, Reportable Conduct includes conduct such as:

a) breach of Health and Safety Regulations

b) breach of other legal / regulatory obligations

c) fraud of any kind including:

- dishonesty and criminal behavior

- the use of deception to obtain an unjust or illegal financial advantage, or

- intentional misrepresentation affecting the financial statements by one or more people among management, employees or third parties.

d) substantial damage or danger to the natural environment

e) breach of Iress’ internal policies and procedure

f) conduct likely to cause Iress financial loss or damage its reputation

g) bribery

h) harassment, discrimination, victimization or bullying

i) Taking or threatening to take detrimental action against a person who has made a disclosure or is suspected to have made, or planning to make a disclosure, or

j) the deliberate concealment of information tending to show of any of the above.

Generally, Reportable Conduct does not include personal work-related grievances such as an interpersonal conflict between you and another employee or a decision relating to your engagement, transfer or promotion.

If a person is uncertain whether something falls within the scope of this policy they should seek advice from the Legal team.

Disclosures that are not considered Reportable Conduct, do not qualify for protections as outlined under this policy.

Reports to be made with reasonable grounds

If you make a report, you are not required to prove your concerns, but you must have reasonable grounds to suspect Reportable Conduct. In practice, this means that there is more than a suspicion of potential Reportable Conduct and there is some information that supports the allegation.

Iress will focus on the substance of the report, not the motivation for making it. As long as your report is made with reasonable grounds, you will receive the protection and support set out in this policy even if your allegations turn out to be incorrect or unsubstantiated.

False reporting

False reporting will be treated seriously. If we find that you have intentionally made a false report (for example, if you know a report is untrue and you report it to harm, annoy, or cause distress to someone), we may take disciplinary action against you.

What should I do if I have a personal work-related grievance?

Iress encourages everyone to speak up about concerns. However, reports that relate solely to personal work-related grievances are not generally considered to be Reportable Conduct and are therefore not covered by this policy.

Personal work-related grievances typically relate to an individual’s current or former employment arrangements, performance, remuneration outcomes or personal circumstances that do not have significant implications for the organisation (for example an interpersonal conflict between you and another employee).

Personal work-related grievances should be raised via your team leader or with People@Iress

There may be some instances where a personal work-related grievance may qualify for legal protection depending on local policies and applicable law.

5. How to make a whistleblowing report

Iress encourages the reporting of actual or suspected Reportable Conduct to us as soon as you become aware of it. There are several channels of reporting available to you. In most cases, you may be able to raise any concerns with People@Iress who may refer the matter to the Iress Legal team. If you do not wish to raise the matter with People@Iress for any reason, you may contact the Legal team directly.

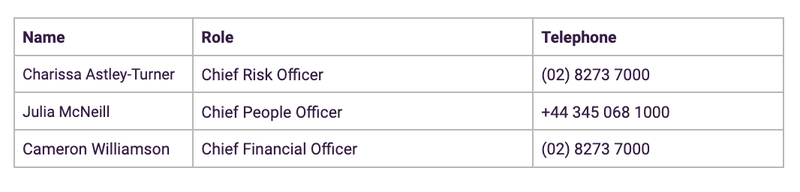

We encourage you to make a report to one of our Disclosure Officers:

Every officer (which includes all directors & the company secretary) are considered eligible recipients under the Corporations Act and are able to receive whistleblowing disclosures.

You may also make a report using our independent and confidential whistleblowing service, Your Call. Reporting to Your Call also enables your report to be made anonymously if you choose to do so. You can make a whistleblower report to Your Call:

Online: https://www.yourcall.com.au/report. You will be required to enter Iress’ unique identifier code: IRESS.

By phone using Your Call’s external reporting hotline (9am to midnight (AEST) on business days):

- Australia - 1300 790 228

- New Zealand - 0800 123 508

- United Kingdom - 0-800-046-5662

How Your Call works

Your Call uses an online message board which you will have access to after making the report. The message board allows you to:

a) communicate with Your Call and with Iress with or without revealing your identity

b) securely upload any relevant documentation and/or material that you wish to provide\

c) receive updates, and

d) request support or report detrimental acts.

The Disclosure Officers will have access to your report. If your report relates to a Disclosure Officer, Your Call will exclude that person from all communications when they provide information about your report to us.

How to use Your Call if you have a speech or hearing impairment

If you are deaf or have a hearing or speech impairment, you can contact Your Call online. If you would like to contact Your Call by phone, you can do so through the National Relay Service. Simply choose your contact method at www.relayservice.gov.au and request Your Call’s hotline 1300 790 228.

6. Confidentiality

You can report Reportable Conduct anonymously or ask that your identity not be disclosed. There is no requirement for you to provide your name or identify yourself at any stage during the reporting or investigation process or after the investigation is finalized. You can also decide not to answer questions that you feel may reveal your identity. You can also choose to provide your identity to the person that you are making the report to but not consent to them sharing your identity with anyone else.

Iress will respect your right not to identify yourself. However, if you choose to remain anonymous, this may affect the ability of Iress to investigate and properly communicate with you about the report. If you would prefer to remain anonymous, you are encouraged to maintain two-way communication with Iress so that Iress can ask follow-up questions and provide feedback. You may choose to use the Your Call service to support any anonymous reporting.

If you are comfortable to do so, you are encouraged to provide your name when you report Reportable Conduct. This will assist where additional information is required to further an investigation.

Notwithstanding the above, a whistleblower’s identity may be disclosed if one of the following exceptions applies:

a) they consent to the disclosure of their identity

b) the whistleblowing concern is reported to a regulatory or enforcement agency as required under law

c) the whistleblowing concern is raised with a lawyer for the purposes of obtaining legal advice.

7. Investigation and outcome

How do we investigate reports of Reportable Conduct?

Reports of alleged Reportable Conduct made in accordance with this policy will be treated seriously and investigated by Iress in accordance with this policy.

Once a whistleblower has raised a concern, Iress will carry out an initial assessment to determine whether it should be reported under this policy or another policy, how it will be handled, and the scope of any investigation. Iress may require further information to complete this assessment.

The precise steps to be taken to investigate a report will differ in individual cases but may include:

a) appointment of an internal or external investigator (if it has been determined that an investigation is required)

b) the investigator or other person asking the whistleblower whether they consent to their identity being disclosed to investigate the report

c) interviewing the whistleblower and any other relevant person to obtain information about the report

d) review of relevant documents and other information in relation to the report

e) the investigator making findings regarding the conduct reported.

The investigation of a report of Reportable Conduct will commence as soon as reasonably possible from the date we receive it. If we think there might be a delay with the investigation, we will tell the person who made the report (where possible).

Where possible and assuming that the identity of the person who made the report is known, they will be kept informed of when the investigation process has begun, while the investigation is in progress and after the investigation has been finalised, subject to confidentiality and privacy considerations. The whistleblower should treat any information about the investigation as confidential.

Iress may decide to take action in response to any findings which may include, but is not limited to, disciplinary action, reporting the matter to an appropriate regulator, conducting training or addressing procedural and policy deficiencies.

If Iress concludes that a whistleblower has made false allegations maliciously, dishonestly or with a view to personal gain, the whistleblower will be subject to disciplinary action.

Treatment of employees who are the subject of a Whistleblower report

Iress will take all reasonable steps to ensure that any employee who is the subject of a report of Reportable Conduct is afforded fair treatment and an impartial investigation in accordance with this policy. Generally, when an investigation is conducted, employees who are the subject of a report of Reportable Conduct may be, within the constraints of confidentiality:

a) told about the substance of the allegations

b) given a fair and reasonable opportunity to respond to the allegations before the investigation is finalised, and

c) informed about the findings of the investigation and given an opportunity to respond to those conclusions before any action is taken against them (subject to legal, privacy and confidentiality requirements).

8. If a whistleblower is not satisfied

Iress cannot guarantee the outcome of the investigation, but Iress will deal with a whistleblower's concerns objectively, fairly and in an appropriate way. If a whistleblower is not happy with the way in which their concern has been handled, they can raise it with the Legal team or any of Iress Directors, as appropriate.

9. Protection, support and fair treatment for whistleblowers and people involved

Iress aims to encourage openness and transparency throughout the whistleblowing process and will support people who raise whistleblowing concerns or complaints, on reasonable grounds, in relation to actual or suspected Reportable Conduct under this policy.

Whistleblowers may be able to seek protections such as compensation and other remedies, and civil, criminal and administrative protections dependent on their jurisdiction, however should seek independent legal advice before doing so.

A whistleblower may also be protected from civil, criminal and administrative liability directly in relation to their disclosure. If the whistleblower has engaged in any misconduct in relation to the disclosure then immunity may not be granted.

No person should suffer any detrimental treatment as a result of raising a concern or complaint pursuant to this policy. Detrimental treatment includes dismissal, disciplinary action, demotion, harassment, discrimination, bias, threats or other unfavourable treatment connected with raising a concern. If a person believes that they have suffered any such treatment, they should contact the Legal team or Your Call immediately. People must not threaten or retaliate against whistleblowers in any way.

Anyone involved in such conduct will be subject to disciplinary action. All files and records created from an investigation into suspected Reportable Conduct will be retained securely. Unauthorised release of information contained within these investigation files and records without the whistleblower’s consent will be a breach of his policy and will be regarded as a serious matter and will be subject to Iress’ disciplinary procedure.

Any investigation undertaken will be aligned with the principles of procedural fairness such as:

a) action and communication in relation to the investigation and subsequent decisions

b) confidential information regarding the investigation should only be communicated on a need to-know basis and all efforts should be made to ensure such details remain confidential

c) records will be maintained of meetings and interviews, including details of those who attended and the agreed outcomes

d) all relevant evidence will be carefully considered

e) investigation findings and recommendations may be documented in a written format.

10. Group reporting procedures

The Board (through the Audit and Risk Committee) will be provided with regular confidential reports on the number and type of whistleblowing incidents to enable it to address any issues at a regional or group level. The Audit and Risk Committee will be provided additional information about any material incidents raised. Reports will be a “no names” basis to maintain the confidentiality of matters raised under this policy.

11. Review, training and further information in relation to this policy

This policy may be reviewed and amended from time to time and will be reviewed by Iress at least every two years. Iress will also conduct ongoing education and training on the whistleblower policy, processes and procedures to all officers and employees.

If you require further information in relation to this policy, or how to make a Protected Report, you can contact the Legal team.

Updated November 2023

Iress is a technology company providing software to the financial services industry.