The evolving profile of an Income Protection customer

This highly anticipated follow-up to last year’s praised report with the Income Protection Task Force (IPTF) leverages insights from over 50,000 applications to reveal a younger, more informed, and proactive IP customer.

These reports are building a foundation of robust, insight-based resources that advisers and industry professionals can rely on year after year. Last year’s findings reignited conversations, energised training, and inspired new approaches - and this year’s report continues that momentum, helping people deliver better outcomes, raise the profile of IP, and make smarter decisions.

By putting these insights into practice, advisers, providers, and protection specialists are better equipped to adapt, innovate, and meet evolving client needs.

The rise of the multi-benefit plan

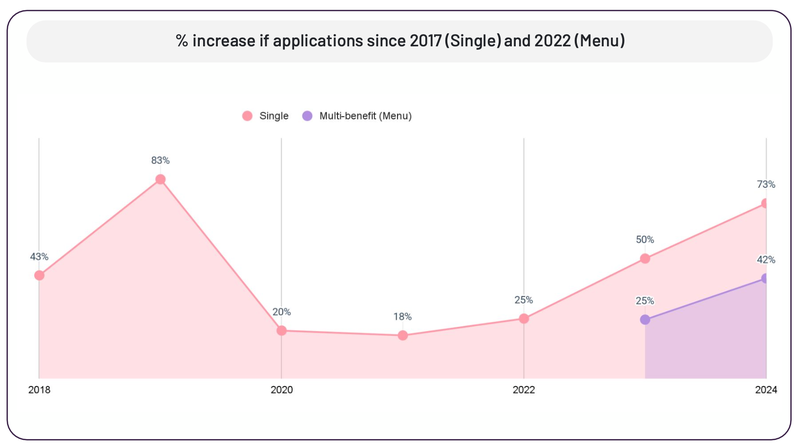

One of the most significant trends we've seen is the growing popularity of multi-benefit (menu) plans. While applications for single IP products have seen a huge 73% increase since 2017, applications for multi-benefit products that include IP have also soared by 42% since 2022.

In fact, in 2024, multi-benefit applications accounted for 48% of all IP applications. This shift suggests that advisers are embracing more holistic conversations about financial resilience.

A younger, smarter customer

The data reveals that those opting for multi-benefit plans are, on average, four years younger than those buying individual products. This younger demographic is showing a preference for long-term security.

For example, multi-benefit IP customers are more likely to have a longer deferred period, with a 3-month period being the most common choice. This choice may be a way for them to balance affordability today with future financial security.

We also found that younger customers are more likely to select policies that escalate with inflation (RPI-linked). In 2024, over a quarter of multi-benefit policies (26.17%) were sold on an increasing Max benefit basis.

Changing choices and consistent trends

Beyond age, we saw other notable shifts in 2024:

Full term policies are back

- For individual IP products, Full Term applications became more popular, making up 50.8% of applications in 2024, up from 46.3% in 2023.

Higher average benefits:

- Average monthly benefit amounts have increased since 2023. For individual policies, the average benefit is £2,238.66, while for multi-benefit plans, it's £1,826.13. The 41-45 age group had the highest average monthly benefit for individual products.

Who’s buying which policies:

- For individual policies, medical professionals and administrators were the most common applicants. For multi-benefit policies, administrators were the most common.

So, what's next for the industry?

Our 2024 data reveals the evolving nature of the IP market, shaped by more informed consumers and comprehensive adviser conversations.

The IP market has made real strides in recent years, with advisers, providers, and protection specialists working hard to raise awareness, expand policy options, and improve access for more people. There’s more choice than ever before, and the industry’s efforts are helping clients see the value of Income Protection.

Yet the "protection gap" remains - according to AMI Viewpoint Report 2024, only 7% of the UK population holds an IP policy, despite 53% recognising its value. This report aims to help advisers spark more conversations - just as our previous report did - and support more people in making Income Protection a core part of their financial plans.

Want to find out more?

Our 2024 report builds on last year’s report, giving advisers and industry professionals the insights they need to turn conversations about IP into action, helping to identify opportunities to talk about IP, introduce it to more clients and shape new offerings.

Download the full report to spark meaningful conversations, raise the profile of IP, and uncover new growth opportunities.