Transformation delivering results at top end of revised FY23 guidance

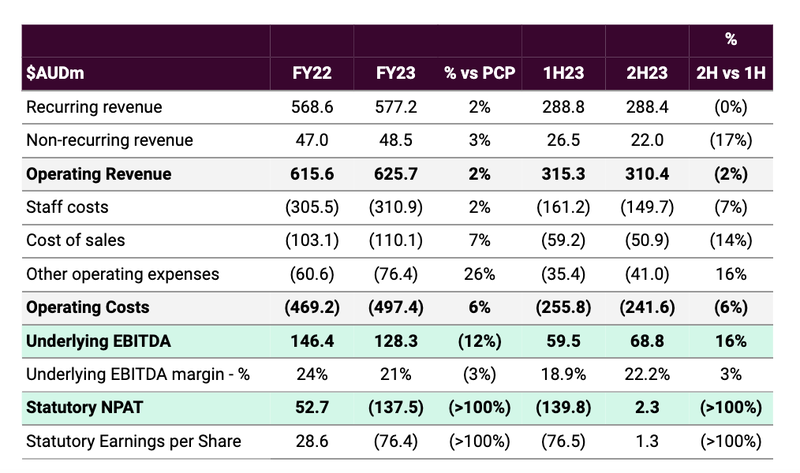

- Challenging year but transformation program progressing well, with 16% improvement in underlying 2H earnings compared to 1H.

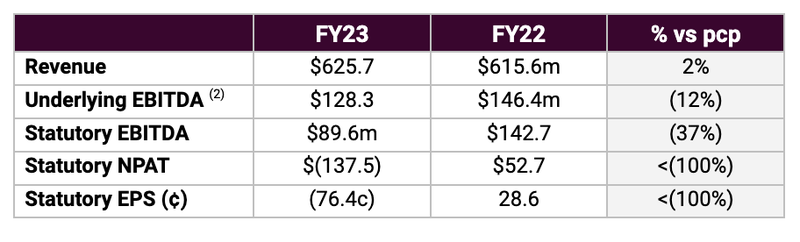

- FY23 revenue of $625.7m and Underlying EBITDA of $128.3m.

- Shift to more transparent reporting with simplified profit measures introduced for FY24.

- New capital management plan: dividend to remain on pause pending further de-leveraging.

- Strongly positioned for growth, with 2024 guidance upgraded.

Iress (IRE.ASX) today announces its financial results for FY23, modestly upgrading guidance for FY24 and providing an update of the business' transformation progress.

Iress’ chief executive officer, Marcus Price, said: “While 2023 has been in many respects a challenging year, Iress is delivering on the commitments made at Investor Day in April and is driving improved performance through our transformation program. Our balance sheet is strengthening, with the sale of MFA and future asset divestments in 2024 being used to retire debt. We’ve successfully enacted a cost management program delivering a 16% improvement in earnings in the second half compared to the first half. Our revenue has stabilised, with improvement in the second half, culminating in a result at the top end of our FY23 revised guidance.”

“Today also marks the beginning of our transition to clearer financial reporting, with fully cost allocated business units and a shift underway towards simplified profit measures. We also completed our new capital management plan which is designed to deliver a stronger balance sheet with lower leverage, create capacity to increase our R&D innovation, and enhance shareholder returns from a cash-generative business.

“Looking ahead, Iress is well positioned to grow in 2024, while also developing our product strategy to reinvent our world-class core platforms and capabilities for the future. We are progressing well - ahead of expectations - and remain on track to complete our transformation program by the end of FY24.”

Full year results 2023

Transformation progress

Iress is executing its transformation well, with all undertakings made at its April 2023 Investor Day on track. The business has arrested notable multi-year cost growth as it implemented measures in the second half of the year with a reduction in overall headcount reducing staff costs. Despite this costs were 6% higher versus the prior year as inflationary input costs were felt across the group. Iress will continue to optimise costs in FY24.

Strong progress was made in the year to repatriate capital through asset sales and retire debt. MFA was sold in October for gross proceeds of $50.5m and Iress has progressed the sale of the Platform business which is expected to complete by 30 April 2024. In addition, Iress has commenced the divestment of its Mortgages business in the UK where there is encouraging buyer interest. The product and technology separation of the South Africa & Canada businesses from the core businesses is also progressing.

Revenue initiatives remain a focus of transformation, with Iress aligning its value proposition to its pricing framework and embedding pricing discipline across the Group. Iress is implementing an improved sales and customer services culture and remuneration is being aligned to customer and shareholder outcomes. Further revenue growth will also come from renewed focus on product innovation in the medium term.

Core business segments

Recurring revenue and market share were stable in the core APAC Wealth Management business, with pricing discipline offsetting economic headwinds and cost base pressures. The business’ launch of Advisely, a community supporting industry innovation and efficiency, during the second half has been well received and growth opportunities are emerging from the Quality of Advice Review through digital and scaled advice, where Iress is well positioned.

Pricing standardisation also supported steady revenue in Iress’ core APAC Trading & Global Market Data business, while costs grew driven largely by people and market data costs. The business made good progress on technology uplift projects and the launch of the Iress FIX Hub highlighting the opportunities presented by next generation cloud-native trading technologies.

Iress’ core Superannuation business delivered growth in recurring revenue through existing and new customer wins, however this growth was offset by the decision to exit non-strategic clients. Increased demand for consulting services boosted non-recurring revenue, setting the foundation for future growth in recurring revenue.The business also reported an increase in restructuring, people and remediation costs in the administration side of the business. Industry demand for digitisation is expected to support revenue growth and activity in 2024.

Clearer financial reporting

As part of its transformation, Iress committed to more transparent reporting of its financial performance. Today the business announces Adjusted EBITDA as its primary reporting metric for 2024 going forward to be supplemented with NPATA which has closer affiliation with the cashflows of the business. Both measures have strong links to statutory profits. Adjusted EBITDA represents statutory EBITDA adjusted for M&A related activity, transformation costs and share-based payments. NPATA represents statutory NPAT adjusted for the after-tax effect of impairment and amortisation of acquired intangibles, and the gain/loss on sale of business assets.

Capital management plan

As announced at the half year, Iress has completed a full review of its capital management plan and is announcing an update today. The capital management plan focused on Iress’ approach to its sustainable earnings, debt and leverage, reinvestment capital via R&D and its dividend policy.

Iress is committed to getting its leverage level down to a range of 1.0x-1.5x from the current level of 2.5x over the coming year. This will be achieved by the sale of non-core assets and retained free cashflow. R&D capex across the group is targeted to increase from its current level of approximately 2-3% of revenue to a range of 5-7% over the medium term as Iress focuses on reinvesting back into its core businesses and develops innovative products.

Iress will consider resuming dividends when the company achieves its target leverage range.

Outlook

Iress’ transformation is creating capacity for growth and sustained success in its core markets. Throughout 2024, the business will focus on revenue growth, cost efficiencies and reinventing world-class platforms and capabilities in its core businesses for the future.

Iress is providing an upgrade to guidance for 2024, with expected FY24 Underlying EBITDA of $137m-$147m, or $117m-$127m on the revised Adjusted EBITDA reporting measure. The expected exit 2024 run-rate at the end of the transformation program is for Underlying EBITDA of $160m-$180m (up from $150m-$170m previously guided), and Adjusted EBITDA of $140m-$160m. These guidance levels are based on the current R&D investment level of 2-3% which is expected to increase to the target level in 2025.

Investor conference call

Investors can participate in the teleconference by registering here.

Alternatively, if you would like to listen to the audio webcast, please pre-register here.

If you are unable to listen to the webcast live, a recording of the call will be provided in the Investor section of our Iress website from Thursday 22 February 2024.

Appendix - detailed financial results

For further details, please contact:

Kelly Fisk