Are you as efficient as you could be?

Chances are you’re not

Data shows that despite heavy investment in IT and operations, many investment management businesses aren’t working as efficiently as they could be and it’s preventing them from achieving the growth they desire.

But why?

We’ve got the answers right here in our ultimate guide for investment managers who want to do more with less. You can read the guide here or download your personal copy to read later.

The inefficiency of wealth management today

The amount of money that investment managers, full-service wealth managers and private banks are injecting into IT and operations is increasing as firms embrace the digital revolution.

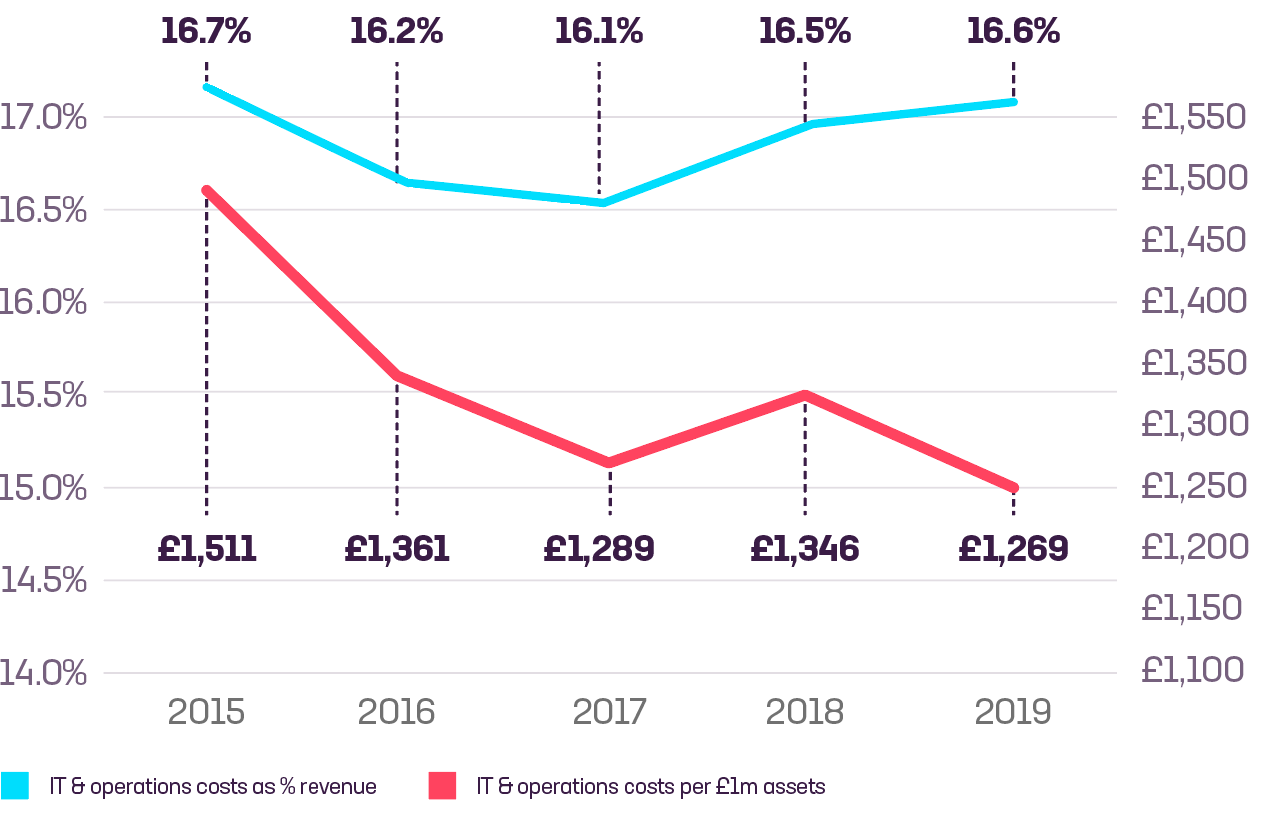

The UK wealth management industry is now spending over £1 billion on IT and operations in a quest for ever more efficient, competitive and profitable ways of working. But are businesses seeing the full benefit of their investment? Data from wealth management consultancy Compeer suggests not. Over the last five years, spend on IT and operations as a percentage of revenue hasn’t fallen, indicating continued operational inefficiencies within wealth management businesses.

A look at spend per £1m of investment assets produced more encouraging results - costs have dropped by £242 - however, given the extent of growth in the industry over this period, these results do not reflect the level of improvement expected.

IT & operations costs within wealth managers

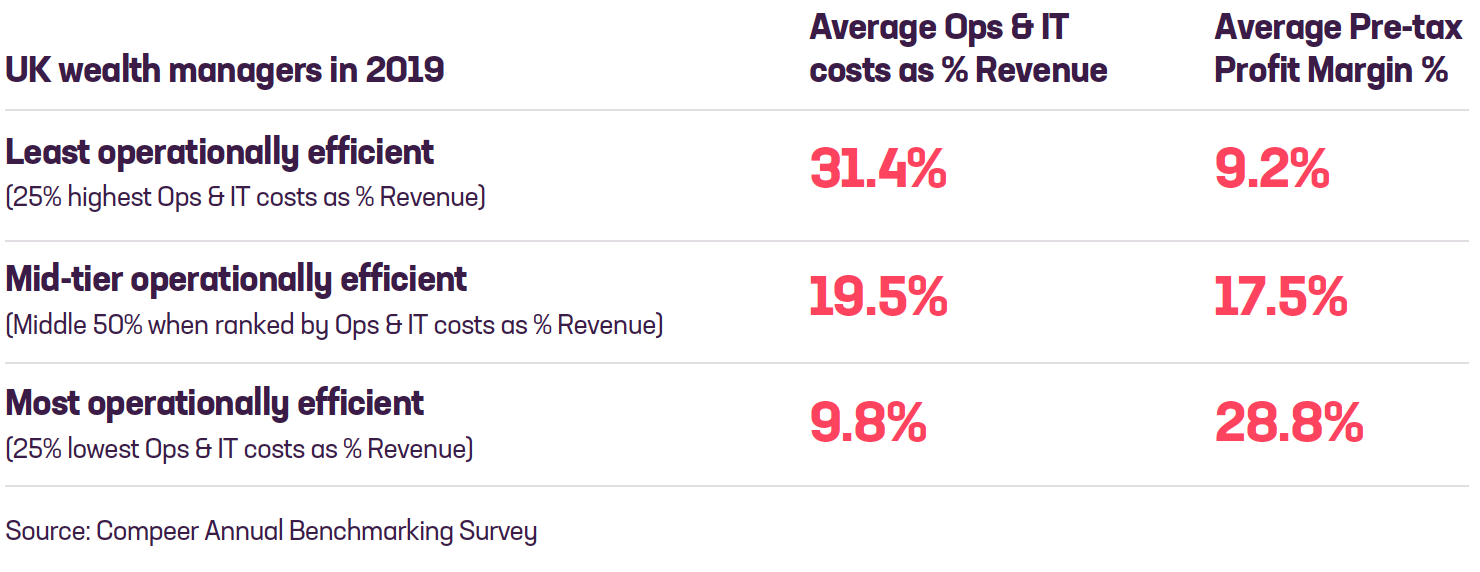

Businesses that are more operationally efficient see the lowest ops and IT costs as a percentage of revenue. In 2019, average costs differed by as much as 21.6% between the most and least operationally efficient wealth management firms in the UK. This clearly had a substantial impact on the bottom-line results, with the most operationally efficient firms exhibiting better pre-tax profit.

What’s holding investment managers back?

The short answer - one you might know already - is the complexity that exists within organisations.

Most investment management businesses are complex by nature. Put it down to acquisitions, combining multiple businesses and the different operational processes that come with them, or having many service propositions and types of clients. The result is often siloed data, complex business processes, varying requirements from different departments, and disjointed technology.

Complexity creep

Many investment management businesses are in a constant battle with below-par external experience (degraded client outcomes) or poor internal experience (inefficient technology and workarounds) leaving them questioning how to scale to service clients from small to large and overcome a lack of resources to support their current technology. In an attempt to make the outcomes better, many businesses are guilty of plugging the gaps in processes or technology and this is what causes complexity to creep in.

The quest for better

The search for new technology is usually driven by this complexity - businesses have too many different processes or providers of software and lots of band-aids holding everything together. They want to see how they can do or use fewer things and deliver better, more consistent outcomes to clients. Ultimately, they want to know how to do more with less.

The answer is clear. They need to simplify, with technology as an enabler, through automation and a reduction in manual steps.

Why investment management businesses should simplify

Simple means scalable

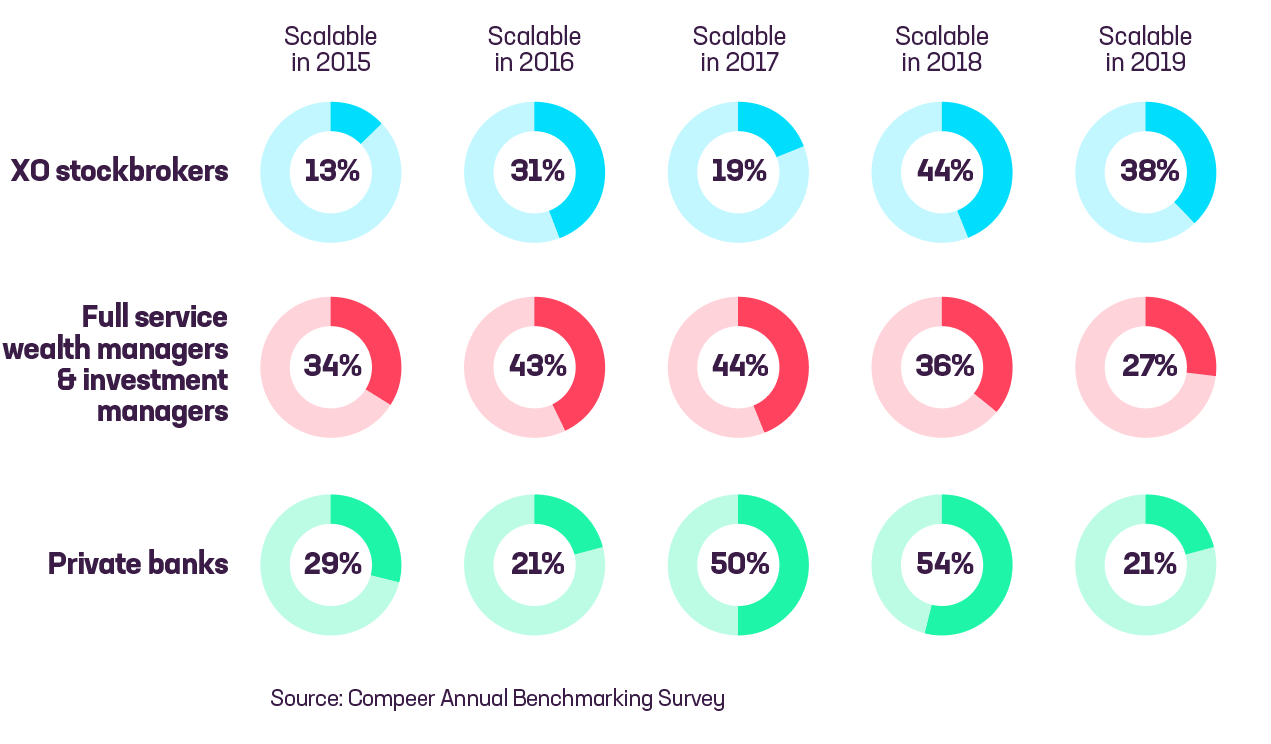

Scalability remains a significant issue within the wealth management industry, with costs surging and engulfing any growth in revenue. Using the definition of ‘scalable’ as a profitable firm that achieves revenue growth and an improvement in profit margin for a given year, just 13 out of 162 firms in the UK were scalable in at least 4 of the 5 years between 2015 and 2019. For most years approximately one in three firms were scalable, but consistently being scalable is where too many firms fall short – a result that is true across all firm types.

Proportion of firms that are ‘scalable’ per year across the wealth management industry

Joined-up technology is a key solution to this problem. It enables organisations to manage many different propositions and relationships with different types of clients through just one system, allowing firms to capture more clients without costs rising in parallel. Therefore the revenue boost instantly supports margin improvement.

Avoid the ‘Swivel Chair’ effect

So much time is wasted entering client information multiple times than having to access various portals and systems to find this information when it’s required. By using integrations in the pain points a firm can achieve a single client view or single client record. For example, if firms are using different platforms to implement investment changes, simplifying by using integrations allows you to continue to use those platforms but from just one screen. This improves client engagement and speed of response. Never again will you have to look in different places for information when a client calls!

Naturally, service levels also improve, potentially boosting the likelihood of referrals (a key source of new business for firms). It also allows front office staff to improve productivity as less time is required per individual client.

More consistency means better client service

Where client reports for one service proposition may have looked different for another service proposition, they now look consistent and hold accurate, up to date data. Ultimately a firm will be able to have one system offering a better experience for both the client and their internal users.

Less risk and (possibly) better investment performance

One source of data means less risk and improved monitoring. For example, firms will not have to worry about market data being priced differently in different systems, and there is only one source for a firm’s investment strategies.

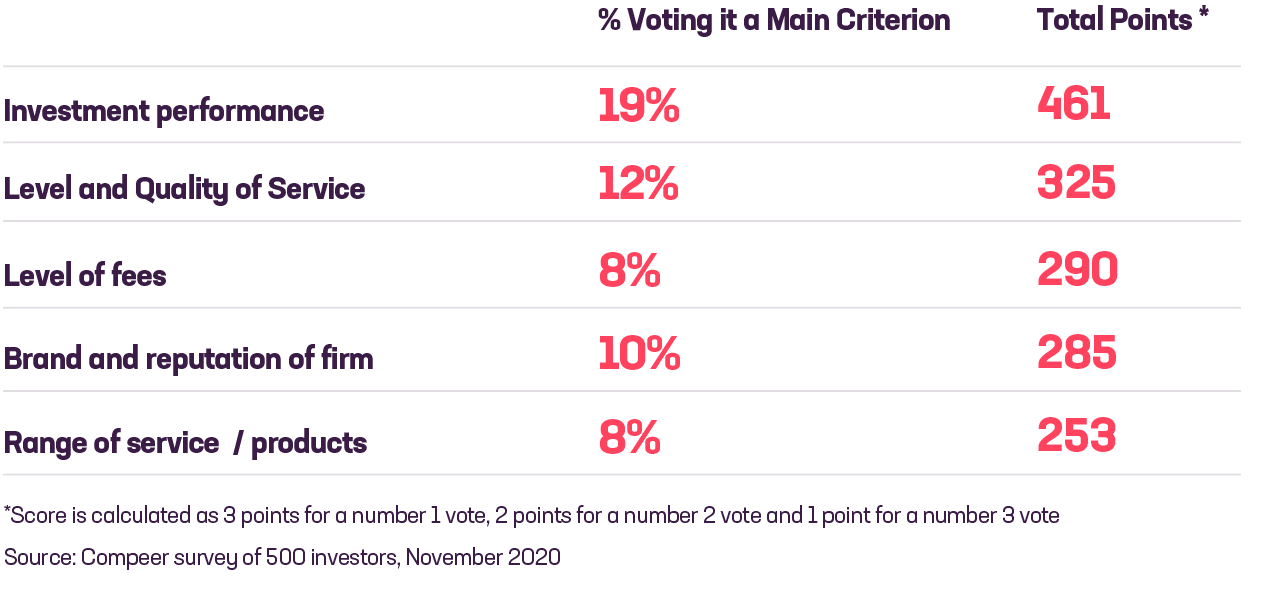

This could then have a knock-on effect for improving investment performance as timing can be vital for investment opportunities. Improvements in investment performance can only be positive, especially as this is consistently the main criteria clients use when both selecting a wealth manager and staying with them for the long term.

What are the top criteria you consider when selecting a wealth management provider?

Streamline to save

A record that firms will rather not see is one in total costs. However, the reality is with their current set-up this is very much the case and year after year all-time high levels of costs are recorded, squeezing margins in the process. It goes without saying that operational efficiencies from having more streamlined systems usually mean cost savings.

More organisations also seem to be recognising that bespoke portfolio management is more costly so many are moving towards model portfolios to get even more simplification, automation and a reduction in costs. The upside is that this also improves scale, manages risk and gives everyone a consistent client experience.

Five steps to simplification

The wealth management industry is very much in a period of change so now is an ideal time for firms to consider how to achieve sustainable efficiencies in their operations, removing cost from the business without damaging the client experience or the organisation’s ability to grow.

Set clear objectives

Identify what problems you are trying to solve. What outcomes do you want? Agree on them at the outset with your technology partner and refer back to them as the project progresses. This ensures everyone is focused on the desired outcomes so implementation is easier and faster.

Decide which area is a priority

Front, middle or back office? Usually, it’s where the quick wins are and what will be most visible to clients but wherever you choose, make sure everyone is on board.

Be open & honest

Honestly assess the internal resources & capabilities you have to achieve the outcomes. For example, before you get too far in check whether you will have the internal engineering capability to help the technology partner manage platform integrations. Share your difficulties with your technology partner.

They might suggest different ways of approaching the project or different ways of doing things. Sometimes these might challenge current processes or what you had in mind. Remember that you’re all working for the same desired outcomes so be open to best practices and their advice.

Be prepared to have difficult conversations

Change management is not easy. Explore with your teams and technology partner why and if certain processes are really necessary or important.

Demonstrate rather than mandate

To get everyone on board, instil in the team the importance of their input and why it matters. Show them what ‘good’ looks like and why the outcomes are more important - help them to see the bigger picture.

Key takeaways

- Operational efficiency is still a key challenge for investment management firms.

- Streamlined systems usually mean cost savings.

- Simplify by using integrations in your pain points.

- Use technology to automate and reduce manual steps.

- Join up your technology to help you scale and improve your proposition.

- A single client view is essential to a better client experience.

- Having one source of data means less risk and improved monitoring.

- Consider using model portfolios.

- Be clear, open and honest with your teams and technology partner.

- Start now - consider how you can do more with less.

Raymond James, want to make work flow better?

If you’d like to simplify the complex and achieve better business performance why not download your personal guide to read another time.

For joined-up private wealth or investment management software that’s less pains and more gains, contact us.