So you’re thinking about changing your trading system. Whether you’re replacing a system you’ve had for many years or wondering if you have all the features you need, you’ve come to the right place.

We will guide you through what to consider, to help you start the right conversations and make an informed decision.

You can read the guide here or download a copy to read later.

Where to start

The first step is to be clear about your objectives. Why do you want to make the switch to a different system? Record all the outcomes deemed as essential to your business - this is critical to ensure a nice smooth transition.

Before you even begin to assess the technology and options available, consider how you will approach the change - do you want a ‘big bang’ change, or would you prefer a staged roll-out?

There are pros and cons to each. Business continuity could be affected by a ‘big bang’ approach if post-implementation fixes are needed to smooth things out. On the other hand, a staged roll-out can mean using your legacy and new systems in parallel for a little while, which can be costly and you’ll need to consider any impact on your clients.

The best approach for your business will be dependent on your team structure, architecture, business focus and appetite for risk - all things that your technology partner should discuss with you.

FIX connections, regional changes and memberships to exchanges should also be part of the decision-making process. No matter what approach you take, ensure that all dependencies, whether internal or external, are identified, considered and discussed with your technology partner, and the desired outcomes agreed from the outset to avoid any dreaded scope creep.

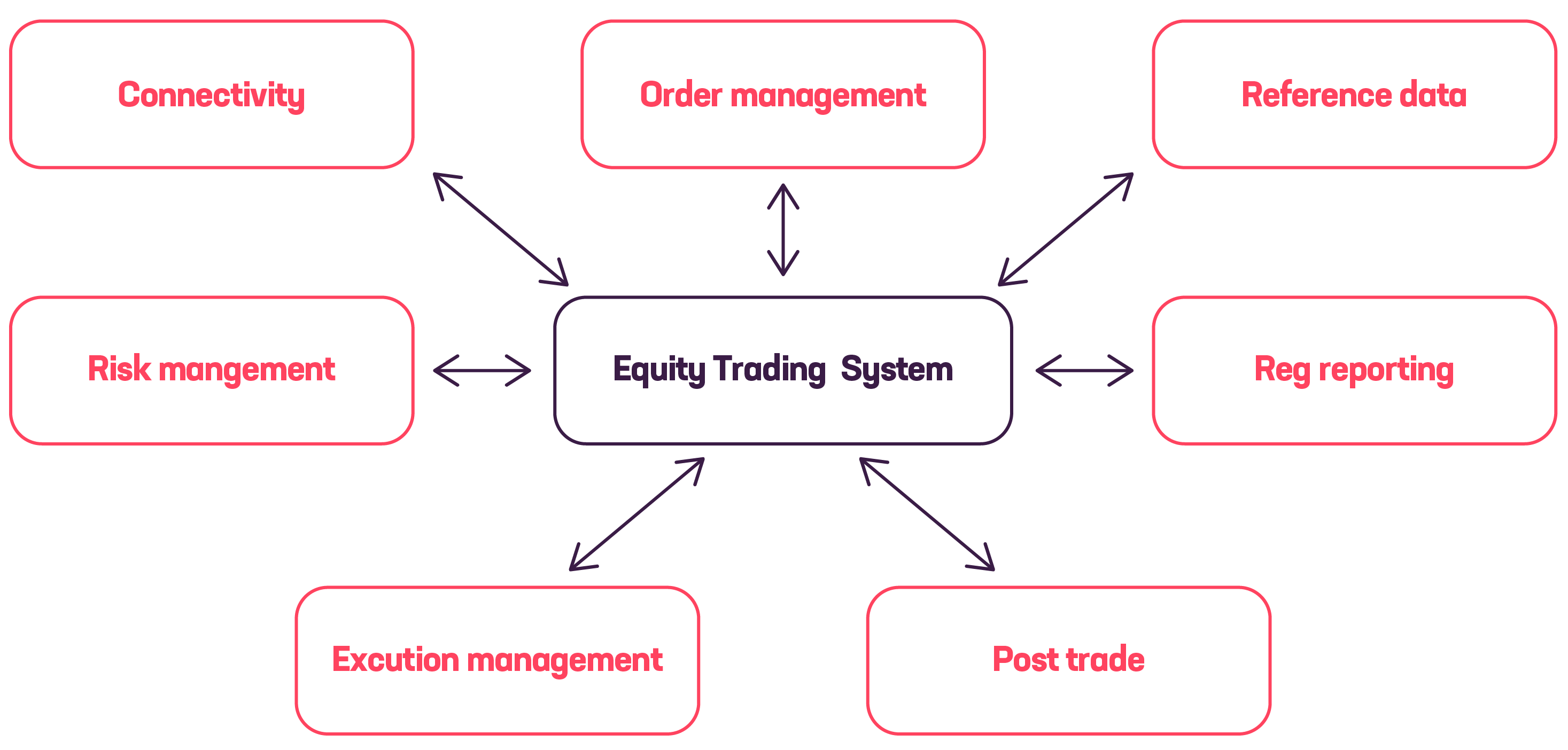

What to look for in a trading system

So what should you look for in a system and how can you best compare one from another? Here’s a summary of the main features you should expect as a minimum.

Connectivity

Start by asking your technology partner or providers about the connectivity that their solution provides. With more sell-side firms expanding their trading business into new markets and exchanges, and the need to meet greater demand from clients for FIX connectivity, it’s a significant part of any trading system.

Reference data

Thanks to MiFID II’s introduction of the requirement to disclose the legal entity identifier (LEI) for each underlying investor entity and demand from clients to change their fee structures, the ability to provide sufficient reference data cost-efficiently is a critical aspect of any new trading solution.

Regulatory reporting

Already mandated in Europe, the landscape for regulatory reporting of trades and transactions continues to be critical, you’ll want to make sure the functionality to produce the necessary reports is built into the system.

Risk management

With risk management of continued focus for sell-side firms and risk departments expecting ever more timely and granular data on trades, a trading system must be able to provide risk departments with better access to and visibility of trading activity. This must also include the functionality to allow risk parameters to be defined for automated trading decisions and risk calculations made, as well as the ability to include any number of external data fields.

Order management

Order management is one of the most functionally-dense areas of a trading system and the one you’ll probably use most. It’s important to make sure the user-interface - the way it looks and works - is user-friendly.

Intraday P&L

The ability to calculate and display intraday P&L is an increasingly desirable capability for sell-side front offices as margins tighten, so any system must be able to capture all relevant details.

Market data

Check your technology partner’s ability to provide market data. Some provide their own, others don’t but can provide it to the system via an API from an external source.

Post trade / middle-office

Most users now expect post-trade/middle-office functionality from their trading system to help deal with and automate regulatory reporting, removing the need for separate systems and processes.

Infrastructure & architecture

Finally, there’s the technology partner’s infrastructure & architecture to consider. Client support, development, latency and service levels have all become major factors in a firm’s decision-making process.

Considerations when implementing a new equity trading system

Buyer’s checklist

Our handy PDF guide covers the key functional and non-functional aspects you’ll want to consider when assessing a new system.

Whether you are considering a bespoke or 'out of the box' solution, having the opportunity to configure a trading system to meet the way you work will mean you get more value from your investment, because you won’t be paying for functionality that doesn’t support you in the right way.

1. Connectivity

Exchange Connectivity - Can the appropriate exchanges be connected to the system?FIX Connectivity - How easy is it to switch over both inbound and outbound FIX connections for brokers, clients and exchange mnemonics?

Algorithms - Can the system connect to the required external broker algos?

Central Trade Manager(CTM) - Can the solution connect to the external electronic trade confirmation service CTM?

Open API’s - Can the solution integrate or partner with data sources and downstream platforms (e.g. back-office settlement and clearing) via real-time API's or batch-based interfaces?

Broker - Is it possible to connect to an external broker for Direct Market Access (DMA)?

Transaction Cost Analysis (TCA) - Does the system include both pre-and post-trade analysis?

Clearing/Back-Office - How does the system connect to back-office service providers and clearinghouses?

2. Reference data management

Corporate Actions - Can the system manage issues relating to static data and corporate actions, and can it automatically update instrument static data per corporate action?Tickers - Is the system able to support and map to multiple vendor tickers?

Client Data - Is client reference data pertaining to the calculation of taxes, levies and additional fees held for all major markets?

LEI - Does the system hold an LEI database or facilitate the record-keeping of LEI’s?

Security File - Does the system hold a Security Master File?

3. Regulatory reporting

OATS Reporting* - Can the system report all relevant trading activity to FINRA’s Order Audit Trail System (OATS) by 7 am T+1?Trade Reporting - Does the system meet the requirements for timely trade reporting to the appropriate source?

Trade Reporting - Does the system offer the appropriate link to an Approved Reporting Mechanism (ARM) to meet the MiFID II requirement for transaction reporting?

Transaction Reporting Business - Does the system facilitate reporting responsibilities for non-UK for UK & Non-UK markets and exchanges?

(*Where applicable)

4. Risk management

Access & Visibility - Can profiles be set up with different levels of access to prevent users from being able to change static data or trade data on a T+0 and T+1 basis?Access & Visibility - Is there a risk management window to visualise the complete trade controls environment, including all real-time and static limits?

Access & Visibility - Can the audit trail show the full lifecycle of an order or child order, and does it detail changes, cancel / amends and controls?

Access & Visibility - Is the system able to impose real-time, dynamic hard cash limits?

Audit Trail - Can the system identify stocks marked as being on a 'watch list'?

Limits - When a client is approaching a hard limit, can the system generate popup windows to alert the user?

Alerts - Can the system provide risk limit warnings configurable to each defined client?

Alerts - Are the definitions for the alert received clear to the user?

5. Order management

Alerts - Can the system generate an alert/pop-up when auto-accept is on and a new trade has come through?Audit Trail - Can users access up to and at least 90-days of core trade data?

Audit Trail - Is a full audit trail retained, with details including when an order was created, at what price, what changes were made to that order, time of changes and by whom?

Auto-accept - Can users toggle order auto-accepting functionality on or off?

Book Structure - Can the system support multiple entities with segregated underlying book structures?

Cancel / Amends - Can front-end users be limited to T+0 post-trade amendment?

Broker / Market Fill - Does the system notify front-end users of all broker/market fills?

Layout - Can brokers manage parent and child orders, with separate windows within the system for parent, child and routed orders?

Layout - Can the user track single stocks across multiple screens?

Layout - Does the system support a VWAP monitoring tool that can present an amalgamated single view of the VWAP for a particular stock on all UK exchanges and on all European exchanges?

Layout - Does the system show full level 2 market depth for selected stocks in the interface?

Commissions - Can the system allow a flexible scaling commission rate that is specific to clients and volume?

Indication of Interest (IOI) - Can the system automatically update IOIs based on the fills being received?

Monitoring - Can the user drill down into an order and view FIX / TAG messages within the user interface?

Workflow - Is the trade type indicator configurable both at account-level and on a per-trade level?

Workflow - Can parent order modifications or cancellations be propagated to child orders?

Workflow - Can a user allocate a child order that breaches order limits on the parent order without having to cancel and replace the original parent order?

Workflow - Does the system apply controls to the modification of child orders based on parent orders?

Workflow - Can the user book manual trades?

Workflow - Can FIX orders be modified?

Workflow - Can orders be aggregated? When the underlying part of the order is routed can the remaining balance be released?

Order Routing - Can orders be routed from one region to the other?

6. Execution management

Configurable Order Routing - Can static orders be routed to exchanges and liquidity venues based on parameters?Indications of Interest (IOI) - Can the user create an IOI from scratch?

Indications of Interest (IOI) - Can a user create IOI based on an existing order?

Indications of Interest (IOI) - Can the system refresh an IOI based on available quantity?

Indications of Interest (IOI) - Can a live IOI be updated based on fills received?

Hot Keys - Can the user set up specific order routing hotkeys and share these with the book or desk to which they belong?

Crossing - Can orders be crossed? Can crossing at the midpoint be set as a minimum requirement?

Trade Management - Can users configure the user interface for GTC- and GTD-orders so that when they roll over to the next day?

Algorithmic Trading - Can users map proprietary algorithms provided to third-party clients on a DMA basis to the algorithmic strategies of the DMA providers?

8. Post Trade / Middle Office

View - Does the system support a tabular view/query window to pull up different windows?Confirmations - Can trade confirmations made via CTM be sent as Block or Allocation?

Confirmations - Can standard and customised templates be set up?

Confirmations - Is the system able to switch off confirmation on a per-trade basis?

Fee Calculations - Can complex fee transactions for non-UK markets such as France, for example, be correctly catalogued?

Give-ups - Can the user enter a GIVE UP broker and then it be reported to an internal or external source, such as Traiana?

Pricing - Can the user mark an order with Net Price and calculations of fees included?

Cancel / Amends - Can the middle-office team amend or adapt a trade that has already been booked?

Commission & P&L Calculation - Can commission charging rules be loaded and edited in the system?

Alerts - Are alerts generated for failed transaction and trade reports?

9. Market Making

Exchange Connectivity - Can clients specify direct exchange connections?MM Logic - Does the system include market-making logic, quote management and quote protection?

Risk Controls - Does the system include pre-trade risk controls, limit monitoring and alert levels?

Risk Management - Does the system include position keeping and risk management tools, and real-time in-depth P&L?

RSP Connectivity - Does the system offer connectivity to RSP networks?

RSP Quoting - Does the system offer the functionality of an RSP quoting engine?

Quoting - Can the user control quoting obligations to exchange on an ad hoc basis?

Limits - Can the user control single stock and book limits?

Orders - Can the user fill client orders from a proprietary book structure?

Stock - Can the user mark stock as market-making quotable stock?

Book Structure - Can the system define books from proprietary to client business and enable a two-way process?

Trade Advertisement - Can users create a Trade Advert based on orders executed in the system?

Trade Advertisement - Can users create Trade Advert based on specific client order?

Trade Advertisement - Can users send Trade Adverts intraday?

Trade Advertisement - Can users manage the distribution lists for trade adverts Including external vendors?

10. Market Data Integration

Entitlements - Does the system support management and tracking of market data entitlements?Reference Data - Does the system allow all users to access reference data and symbology data from all sources?

Trade Data - Does the system suppress data upon client request if required to facilitate the clients trading model?

Market Depth - Does the system provide full and delayed L1 & L2 market depth?

11. Infrastructure & Architecture

Support - Is there a defined release management process?Support - What level of quality and robustness can the technology partner provide?

Deployment - Will the technology partner support the system installation?

Disaster Recovery Site - Where is the DR Site?

Disaster Recovery Site - Does the DR Site run a separate data centre?

Disaster Recovery Site - Is the DR site on independent Network and Power sources?

Infrastructure - Is the system on-premise, hosted or SaaS?

Service Levels - How resilient is the system and are the service levels acceptable?

Service Levels - What options does the technology partner offer with regards to redundancy?

Perform better every day

Like any major change, moving to a new trading system is a daunting prospect. But swapping out your tired, old legacy trading system to one that’s better suited to your vision and the way you want to work will significantly improve your business’ performance every day. We hope this guide has helped you step closer towards making that a reality.

For faster, smarter trading, market data and connectivity for institutional traders, including remarkably versatile order management software, contact us.