Switching to a new system is a big decision for most businesses - even when you know it’s the right one to make. Charlie Nicholls, partner at CPN Investment Management , talks about moving their practice from Adviser Office to online financial advice software, Xplan, and why they haven’t looked back.

Such a weight off us

“We’d been using Adviser Office from Iress for over 12 years but noticed we were starting to creak at the seams. We knew we needed a new CRM system that would grow with the business so spoke to Iress about Xplan and decided to upgrade to it.

“Iress managed the whole transition to Xplan for us which kept disruption to a minimum. Now our back office system is no longer on a server in our offices. Outsourcing that whole service structure to the experts is such a weight off us, everything is taken care of so we can focus on the business and our clients. We wish we’d done it sooner.”

No more manual data feeds

"Previously, all our data feeds were manual and had to be checked by a team for two or three hours each morning. In Xplan, data feeds update automatically so now it’s a job for one person, once a week and the team can get on with more important client management work.

"Our team used to spend two or three hours every morning checking data feeds. Now it’s a job for one person, once a week."

Capacity to take on more cases

"The ‘cases’ functionality within Xplan helps us a lot. In a nutshell, it means we can set up an automatic workflow of tasks to ensure everything is done in the right order across the team, for consistency and complete compliance."

"It's far more sophisticated than Adviser Office."

"Previously, a staff member might have managed only five or six cases at a time, now each person can easily handle 12 to 15 cases and that’s all down to the automation in Xplan. It’s far more sophisticated than Adviser Office.

Easier to ‘be digital’

“Things like MSM messaging and emails are also integrated into Xplan which makes it much easier to be ‘digital’ and stay connected with our clients. And because everything is held in one place in Xplan, it’s also easy for us to show we’re meeting the FCA’s increasing regulatory requirements.”

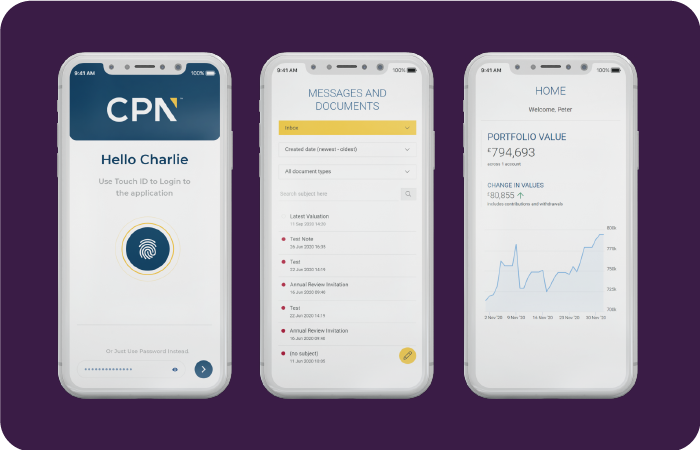

“We use the Xplan client portal which has become core to what we do - especially post-pandemic. People are used to checking bank balances on their mobile phones, it would seem foreign to them to receive a quarterly statement in the post. We find clients are much more engaged and prefer it. We can also track how active they are which helps us understand what they are interested in and how we nurture that client.”

Just do it

“If you’re considering moving to Xplan, our advice would be to just do it! The Xplan system is leaps and bounds ahead of the old Adviser Office system. Admittedly, the actual switch process is going to take quite a lot of your time and effort for a couple of months but after that, everything is so much easier. There is a dedicated team at Iress that help make it a smooth transition.

"The Xplan system is leaps and bounds ahead of the old Adviser Office system."

We’re really happy with the way we work now and feel since switching to Xplan, we are better prepared for the future. We’re never looking back.”

Be more Charlie

You could be better prepared for the future and get on with more important client work just like Charlie and his team. Make your team and your business happy by upgrading to Xplan. Get in touch with your account manager to get the ball rolling.