What were you doing ten years ago?

Perhaps you were on your iPhone 5 playing Angry Birds. If you were really ahead of the curve, you would’ve been booking a taxi or a place to stay on a brand new app called Uber or Airbnb. And if you were in the mortgage business back then, chances are you were tapping away on your desktop PC using the height of mortgage sourcing technology - Trigold Prospector.

You might still use Trigold now. You may even still call it Prospector. Fact is, we all like what we know but technology moves on, should you?

Then vs now

The 32-bit program you used in 2011 might stream your favourite Netflix series, but the quality would be terrible. If you used the 3.5GHz processor in your computer to do a mortgage now, you’d be banging your head on the desk.

Our experiences and expectations change. Just as no broker would ever dream of going back to the days of looking up the best rates in the Moneyfacts paper, most now couldn’t imagine operating offline on a desktop having experienced working faster on mobile and online.

Ten years ago, when we published our first mortgage efficiency survey, most mortgages were done face to face and direct. Fast forward ten years, and over 90% (Intermediated mortgage applications +90% in 2021, compared to 77.5% in 2020. Iress mortgage efficiency survey 2021) of mortgages are intermediated. The increased reliance on intermediaries, particularly since the pandemic, has welcomed new developments in broker technology, revolutionising the way mortgage business gets done.

Need to get up to speed? Here’s our pick of the best:

1. Criteria research with Knowledge Bank

Four years ago, there was no such thing as a criteria search system. Now it’s hard to imagine how a mortgage broker could do their job without one. Finding out who would take your case used to involve phoning round help desks and many different lenders, which could take hours, sometimes days.

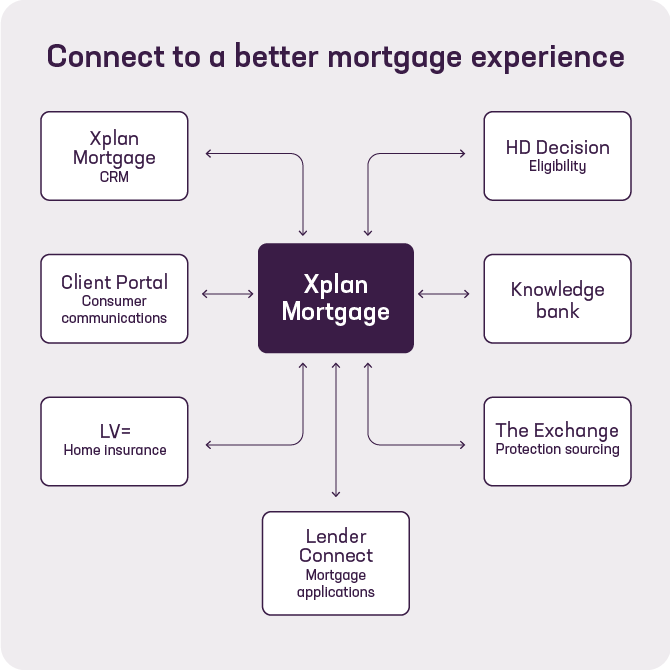

It wasn’t until recently that an integration between Xplan Mortgage and the multi-award-winning criteria research system Knowledge Bank enabled brokers to search for product criteria and source in the same place. This development makes finding the best available mortgage product quicker than you can say Japanese Knotweed.

2. Experian’s HD Decisions eligibility tool

Experian’s HD Decisions eligibility tool revolutionised the mortgage journey for consumers when it launched in 2018, giving homebuyers the chance to find out which mortgages they are likely to be accepted for and how much they could borrow.

The same eligibility checking service has since been built into Xplan Mortgage, allowing brokers to perform a soft credit check for applicants with multiple providers in one hit. By avoiding running individual affordability and eligibility checks with several lenders, the time savings are substantial. It’s also helping more advisers and clients get through the mortgage application process faster and with more certainty of outcome.

3. Protection sourcing from The Exchange

Launched in 1998, The Exchange has long been the ‘go-to’ software for financial advisers and brokers needing to research, quote and compare for their client’s protection needs. Continued innovation has kept The Exchange the number one comparison tool in the market and building its protection quote service into Xplan Mortgage, takes things a step further.

While protection has traditionally been sold towards the end of the mortgage journey, there are obvious benefits to identifying a client’s protection needs earlier in the process. With protection quotes from The Exchange in Xplan Mortgage there’s no need to wait, advisers can source a mortgage and a suitable protection product at the same time in the same system. It all reflects a move towards a smarter, more streamlined way of working. After all, why put up with multiple systems and processes when one gets the job done?

4. Direct applications with Lender Connect

API technology is connecting brokers and lenders in ways unseen before, and one of the best examples of this is Lender Connect.

Available in Trigold and Xplan Mortgage (where you’ll experience it at its best), Lender Connect is a faster, infinitely better way to apply for mortgages. Just click a button to connect directly with a lender’s portal and automatically see the client’s pre-populated data.

With time-savings of anything from 20 to 60 minutes per case, plus a lower risk of errors, it won’t be long until logging into lenders’ portals to retype and cross-check information is seen as outdated.

Mortgage intermediary software has never been better

Mortgage intermediary technology has moved on a lot in the past ten years. If your business hasn’t, it’s time to take advantage of the new software on offer.

The latest innovations remove frustrations and inefficiencies in the end-to-end mortgage process and provide access to the latest knowledge to help deliver the best advice. Better integrations between mortgage software and third-party applications and tools make the use of multiple screens, systems and disjointed processes a thing of the past.

With the right software, doing mortgage business - even complex cases - has never been so easy nor efficient. It’s good now, just imagine what it’ll be like in another ten years.

Get your business moving with Xplan Mortgage

You’ll find all these latest developments (and more) in Xplan Mortgage, the ultimate mortgage software platform for forward-thinking brokers. Join the many Trigold users moving to Xplan Mortgage, and you’ll never look back.

Make the first move by coming along to a free, no-obligation demo.