- Home

- Investors

- Governance documents

- Share trading policy

- Investors

- Calendar

- ASX Announcements

- Results & reports

- Board of Directors

- Share information & registry

- Corporate directory

- AGM

-

Governance documents

- Anti bribery & corruption policy

- Audit & risk committee charter

- Board charter

- Code of ethics & conduct policy

- Conflicts of interests policy summary

- Disclosure & communication policy

- Diversity policy

- Gender diversity

- Modern slavery act statement

- People & performance committee charter

- Share trading policy

- Speaking Up Policy

- Anti-Fraud and Fraud Awareness Policy

- Supplier Code of Ethics

- Reward Plan Rules

As a director or employee of Iress Limited or its subsidiaries (Iress), you may have access to price sensitive or 'inside' information about Iress that is not generally available to the market at large.

Having access to inside information has implications under Australian insider trading laws (which apply whether or not you are in Australia) and this policy explains what that means for you.

1. Purpose & Scope

As a director, employee or contractor of Iress Limited or its subsidiaries (Iress), you may have access to price sensitive or 'inside' information about Iress that is not generally available to the market.

Inside information is any information that a reasonable person would expect to have a material effect on Iress’ share price (positively or negatively) that is not generally known to the market. Examples include a proposed acquisition or sale of business, information about Iress’ financial performance against its budget or forecasts, senior management or board changes, a proposed capital raising, and entry into or termination of a significant customer contract.

Having access to Inside Information has implications under Australian insider trading laws (which apply whether or not you are in Australia) and this policy explains what that means for you.

Important:

- Insider trading is a crime which can have very serious consequences. Therefore, you must exercise care and judgment in deciding whether to trade in Iress Securities.

- Directors and employees must only Trade in Iress Securities during a “Trading Window”. You must not Trade in Iress Securities outside of a Trading Window.

The purpose of this policy is to assist Iress directors, employees and contractors to comply with their legal obligations, promote Iress’ commitment to good governance and to protect Iress and its reputation.

1.1 Who does this policy apply to?

All directors, employees and contractors of Iress (and their "Associates" – see below) must comply with this policy.

1.2 Key terms used in this policy

This section sets out some of the key terms used in this Policy and their definitions:

- Associate: includes your family members, trusts, companies, nominees and other persons over whom the director or employee has, or may be expected to have, investment control or influence. If you are in doubt as to whether a person is your “Associate”, you should contact the Company Secretary.

- Inside Information: refer to section 3.2.

- Iress Securities means:

- all Iress ordinary shares; and

- any other share or security of Iress, including all options, performance rights, notes or debentures and financial products issued or created over or in respect of securities issued by Iress.

- Restricted Person means:

- Direct reports of the Managing Director & Chief Executive Officer (CEO);

- the Company Secretary;

- the General Counsel, APAC;

- the General Counsel, EMEA;

- the Deputy Chief Financial Officer;

- the Head of Group Tax and Financial Control;

- direct reports of the positions listed in (i) to (vi); and

- other employees nominated by the Managing Director & CEO, Board or Company Secretary as being a Restricted Person (and who are notified accordingly).

- Trade or Trading: includes buying, selling or applying for Iress Securities, or agreeing to do any of these things, either on your own behalf (which includes directing another person like a broker to execute a trade) or on behalf of someone else.

1.3 Who do I contact if I have questions?

If you have any questions regarding this policy, please contact the Company Secretary.

2. Trading Windows

2.1 What are Trading Windows?

Directors and employees must only Trade in Iress Securities during a “Trading Window”. You must not Trade in Iress Securities outside of a Trading Window.

Iress’ Trading Windows are the following periods:

- the four week period commencing on the business day after the release of Iress’ full year results to ASX;

- the four week period commencing on the business day after the release of the Company’s half year results to ASX;

- the four week period commencing on the business day after the Company’s annual general meeting;

- any additional periods permitted by the Board from time to time.

The Board may vary, suspend or close a Trading Window at any time. Notice of such changes will be communicated by the Company Secretary.

Important: The insider trading prohibitions apply at all times, including while a Trading Window is open. If you have Inside Information, then you must not trade in Iress Securities. Directors and Restricted Persons must also comply with the requirements in section 2.2 prior to Trading.

2.2 Additional requirements that apply to Directors and Restricted Persons

Directors and Restricted Persons (and their Associates) who wish to Trade in Iress Securities during a Trading Window must adhere to the following requirements:

- Directors (other than the Chair) and their Associates: if a director (other than the Chair) or their Associate wishes to Trade in Iress Securities, the director must obtain the written approval of the Chair before any Trading occurs.

- Chair and their Associates: if the Chair or their Associate wishes to Trade in Iress Securities, the Chair must first seek the written approval of the Chair of the Audit & Risk Committee or, failing the Chair of the Audit & Risk Committee being available, the Chair of the People and Performance Committee, before any Trading occurs.

- Restricted Persons and their Associates: if a Restricted Person or their Associate wishes to Trade in Iress Securities, they must first obtain the written approval of the Managing Director & CEO, Group Chief Financial Officer or Company Secretary before any Trading occurs.

A request to trade must state that the proposed Trade is not as a result of access to, or the receipt of, Inside Information, and must specify the number or amount of Iress Securities involved.

An approval to Trade will last for 3 business days unless it is withdrawn earlier. The granting of approval to trade is not an endorsement of the proposed Trade. Individuals remain responsible for their own investment decisions and their compliance with the law.

If approval to trade is refused, you must keep that information confidential.

2.3 Subsequent notification of Trading - Directors

Directors must notify the Company Secretary in writing of all Trading in Iress Securities within 3 business days. Directors must provide sufficient details of all Trading to enable the Company to file a notice in accordance with the ASX Listing Rules within 5 business days of the Trade.

3. The Insider Trading Prohibition

3.1 What are the insider trading prohibitions?

Pursuant to the Corporations Act, if you possess “Inside Information” (defined below) in relation to Iress, you must not:

- Trade in Iress Securities;

- procure, advise, induce, incite or encourage any other person to Trade in Iress Securities; or

- communicate or pass on that Inside Information to any person if you know, or ought to reasonably know, that the recipient would (or would be likely to) Trade in Iress securities or procure or encourage another person to Trade Iress Securities.

You cannot get around the law by arranging for a member of your family or a friend to Trade Iress Securities. You also cannot give tips of Inside information to others.

Important: Trading when in possession of Inside Information is a criminal offence.

3.2 What is "Inside Information"?

A person possesses “Inside Information” where the information is not “generally available” and, if the information were generally available, a reasonable person would expect it to have a “material effect” on the price or value of the company’s securities.

Information does not need to be true for it to be Inside Information, as Inside Information extends to matters of speculation or supposition as well as matters relating to a person's intentions or likely intentions. Furthermore, it does not matter how you came to know the information. The insider trading prohibition applies whether you became aware of the information through working at Iress or from third parties, or by overhearing the information in passing.

What does “generally available” mean?

Information is “generally available” if:

- it consists of readily observable matter – for example, if it is obvious, or fairly obvious, to investors that an event will likely have a material impact on Iress or its customers or suppliers; or

- it has been brought to the attention of investors through an announcement to the ASX or otherwise similarly brought to the attention of investors who commonly invest in Securities, and a reasonable period has elapsed since it was announced or brought to investors' attention; or

- it consists of deductions, conclusions or inferences made or drawn from information referred to in paragraphs (a) or (b) above (which may include analysts’ commentary on the impact of a particular matter on Iress or news articles that are sufficiently definite).

When will a reasonable person expect information to have a “material effect” on Iress Securities?

A reasonable person will be taken to expect information to have a “material effect” on the price or value of Iress Securities if the information would, or would be likely to influence persons who commonly acquire Iress Securities in deciding whether or not to deal in Iress Securities.

Examples of information that may have a “material effect” on the price or value of Iress Securities include:

- changes in Iress' actual or anticipated financial performance or business performance of a material business unit;

- changes in Iress' capital structure, including proposals to raise additional equity or borrowings;

- proposed changes in the nature of the business of Iress;

- changes to the Iress Board or senior executives;

- a major acquisition or divestment by Iress;

- a new material contract or termination of an existing material contract; or

- a material claim or litigation involving Iress.

3.3 What if the information relates to a company other than Iress?

Whilst this Policy is drafted specifically with Iress in mind, the insider trading laws apply to Trading in all companies. If you have Inside Information about any company, you must not trade in the securities of that company.

The Board may extend this policy such that Directors, Restricted Persons and/or employees are also restricted from Trading in the securities of other specified companies with which Iress may have a close relationship from time to time. Directors, Restricted Persons and/or employees will be notified by the Company Secretary where this is the case.

4. Exceptions

4.1 Exceptional circumstances

You may seek approval to Trade in Iress Securities outside of a Trading Window in exceptional circumstances. You must not be in possession of any Inside Information and must have first received written approval to Trade.

The circumstances in which approval to Trade outside of a Trading Window will be granted are rare, and may include severe financial hardship or where a Trade is required to comply with a court order. Selling shares to pay a tax bill will not generally qualify as exceptional circumstances.

A request to Trade outside of a Trading Window must be made in writing to:

- the Chair (if the applicant is a director);

- the Chair of the Audit and Risk Committee (if the applicant is the Chair);

- the Company Secretary (if the applicant is an employee or contractor of Iress).

The request must demonstrate why your circumstances are exceptional and that the proposed Trade is the only reasonable course of action. The request must state that the applicant is not in possession of Inside Information and must specify the number or amount of Iress Securities involved.

Each application will be assessed on its own merit. Any approval granted is valid for a single application only, and a new application must be submitted in the event that a further exceptional circumstance is encountered.

Any approved Trading must occur within 3 business days of the date that approval is granted unless it is withdrawn earlier.

4.2 Permitted dealings

The following types of dealing are excluded from the operation of section 2 of this policy, unless the Board determines otherwise, and may be undertaken at the relevant time without requiring prior approval:

- a transfer where there is no effective change to the beneficial interest in the Iress Securities (eg transferring a personal holding of Iress Securities into a personal superannuation fund or trust where you are the beneficiary), provided that directors notify the Company Secretary in writing of the transfer within 3 business days.

- a takeover offer for the company, meaning undertakings to accept, or the acceptance of, a takeover offer that has been recommended by the Board;

- a scheme of arrangement involving Iress combining with another entity, extending to participation in the scheme of arrangement;

- rights issues, bonus issues, buy-backs, meaning Trading under an offer or invitation made to all or most of the Iress shareholders, such as a rights issue, bonus issue and an equal access buy-back, where the plan that determines the timing and structure of the offer have been approved by the Iress Board;

- employee equity plans, meaning applying to participate in an employee equity plan operated by Iress, receiving Iress Securities as a result of that application (such as deferred securities, deferred share rights, equity rights, performance rights or share appreciation rights), the acquisition of Iress Securities as a result of the exercise of rights granted under an Iress employee equity plan, the withdrawal of Iress Securities from the Iress Employee Share Trust to any employee and the sale of Securities by Iress to satisfy tax or other obligations imposed by a Government agency pursuant to any law in any jurisdiction. However, this does not apply to the subsequent sale of Iress Securities you acquire under an Iress employee equity plan;

- the NED Share Plan or any dividend reinvestment plan or share purchase plan, meaning acquisitions of Iress Securities under any such plan operated by Iress where an election to participate in the plan and any variation of participation in the plan is made at a time that you do not have Inside Information; or

- disclosure document, meaning subscribing for Iress Securities under a disclosure document such as a prospectus.

However, all such dealings remain subject to the legal prohibition on insider trading and you should ensure that you are not in possession of Inside Information at the time you apply for or acquire securities.

5. Speculative Trading Prohibited by this Policy

5.1 No short term dealings

All directors and employees of Iress are prohibited from engaging in short term dealings in Iress Securities - i.e. the purchase and subsequent sale of shares within a period of less than three (3) months.

Bona fide transactions associated with employee equity plans (e.g. selling deferred securities during a Trading Window after they have been released from restriction or after they have been provided on exercise of a performance right) are exempt from this restriction on short term dealings.

5.2 No short selling

All directors and employees of Iress are prohibited from short selling Iress Securities - that is, the sale of Iress Securities that have been borrowed with a view to repurchasing them at a lower price and returning them to the lender.

5.3 Margin lending

Directors and Restricted Persons must not enter into a margin loan or similar funding arrangement to acquire Iress Securities (which includes transferring Iress Securities into an existing margin loan account, or selling Iress Securities to satisfy a call pursuant to a margin loan) or grant lenders any rights over Iress Securities.

5.4 Restriction on hedging and use of derivatives

The use of derivatives or any other hedging instrument over Iress equity (including Iress Securities subject to a minimum shareholding requirement, restricted Iress Securities, restricted vested equity rights, unvested performance rights or any other unvested equity) is prohibited and those entering into such schemes will be in breach of the terms and conditions of the grant. As a consequence, the Board will exercise its right to cancel / clawback the hedged unvested or restricted equity. Hedging is any arrangement that reduces economic exposure to an investment, for example purchasing a financial instrument that offsets potential gains or losses from share price movements.

6. Breaches of this Policy

A breach of the insider trading laws is serious. You may be liable for both significant civil and criminal penalties. In addition, a breach of this Policy may be regarded by Iress as serious misconduct which may lead to disciplinary action or dismissal.

7. Other Matters

7.1 Monitoring of trading

Iress may monitor Trading of Iress Securities as part of the administration of this Policy. Iress may apply blocks or restrictions on Iress Securities held under an employee incentive scheme to prevent Trading which would breach this Policy.

7.2 Changes to Policy

If any material changes are made to this Policy, the Company will give the amended Policy to ASX for release to the market within 5 business days of the material change taking effect.

7.3 Review of Policy

The Board will review this policy annually.

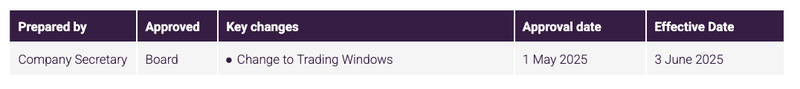

8. Document version control

Dated: 25 January 2024

Iress is a technology company providing software to the financial services industry.