- Home

- Investors

- Governance documents

- Share trading policy

- Investors

- Calendar

- ASX Announcements

- Results & reports

- Board of Directors

- Share information & registry

- Corporate directory

- AGM

-

Governance documents

- Anti bribery & corruption policy

- Audit & risk committee charter

- Board charter

- Code of ethics & conduct policy

- Conflicts of interests policy

- Disclosure & communication policy

- Diversity policy

- Gender diversity

- Modern slavery act statement

- People & performance committee charter

- Share trading policy

- Whistleblowing policy

- Anti-Fraud and Fraud Awareness Policy

- Supplier Code of Ethics

As a director or employee of Iress Limited or its subsidiaries (Iress), you may have access to price sensitive or 'inside' information about Iress that is not generally available to the market at large.

Having access to inside information has implications under Australian insider trading laws (which apply whether or not you are in Australia) and this policy explains what that means for you.

1. What is the purpose of this policy?

This policy sets out Iress' policy on buying and selling or otherwise dealing in Iress Securities by employees and directors of Iress. “Securities” include shares, options, rights, debentures, interests in a managed investment scheme, derivatives and other financial products covered by s1042A of the Corporations Act. This policy aims to:

- protect the interests of Iress' stakeholders at all times;

- explain the sorts of conduct that are prohibited under Australia's insider trading laws; and

- establish a best practice procedure for dealing in Iress Securities.

This policy supports the Iress Code of Ethics & Conduct policy which, amongst other things, seeks to ensure Iress is committed to complying with its legal obligations and acting ethically and responsibly.

Who to contact if you have questions

The insider trading laws and the various rules in this policy can seem complex. A table is set out at the end of this policy to provide an overview.

If you don't understand how this policy works or if you are unsure how it applies to you, please contact the Company Secretary.

You may wish to obtain your own legal or financial advice before you deal in Iress Securities.

2. Who this policy applies to

All employees and directors of Iress (and their "Associates" – see below) must comply with this policy as a term of employment or appointment.

Certain parts of this policy only apply to directors, senior management personnel and Specified Roles (see below), whereas other parts apply to all. See section 4 of this policy for further details.

For the purposes of this policy:

- “Associates” of a director or employee includes their family members, trusts, companies, nominees and other persons over whom the director or employee has, or may be expected to have, investment control or influence. If you are in doubt as to whether a person is your “Associate”, you should contact the Company Secretary.

- Senior management personnel comprises the Iress Executive Leadership Team (excluding the Managing Director, who is included in the Iress Board). If you are in doubt as to whether you are senior management personnel, you should contact the Company Secretary.

- The following positions held within Iress comprise the Specified Roles (each a Specified Role):

- Company Secretary;

- General Counsel, APAC;

- General Counsel, EMEA;

- Head of Group Tax and Financial Control; and

- Commercial Director - Investment Infrastructure.

3. Explanation of the insider trading prohibitions

This section explains some important elements of Australia's insider trading laws that will help you understand how this policy works.

3.1 What are the insider trading prohibitions?

If you have inside information relating to Iress which is not generally available to the market, it is illegal for you to:

a. deal - means buy, sell or otherwise deal in Iress Securities; or

b. procure - means advise, procure or encourage another person to deal in Iress Securities; or

c. communicate - means pass on information to any other person, if you know or ought reasonably to know that the person may use the information to buy, sell or otherwise deal in Iress Securities. This is sometimes called "tipping".

You cannot get around the law by arranging for a member of your family or a friend to deal in Iress Securities. You also cannot give tips of Iress information to others, including clients.

3.2 What is "inside information"?

Inside information is information relating to Iress which is not generally available but, if the information was generally available, would be likely to have a material effect on the price or value of Iress Securities. Something does not need to be true for it to be inside information because inside information extends to matters of speculation or supposition as well as matters relating to a person's intentions or likely intentions.

3.3 When will information be taken to have a "material effect" on the price or value of Iress Securities?

Information is regarded as being likely to have a material effect on Iress Securities if it would, or would be likely to:

- have a material effect on the price or value of Iress Securities; or

- influence persons who commonly invest in Securities in deciding whether or not to deal in Iress Securities.

Some examples of price sensitive information could be:

- changes in Iress' actual or anticipated financial condition or business performance or of a material business unit;

- changes in Iress' capital structure of Iress, including proposals to raise additional equity or borrowings;

- proposed changes in the nature of the business of Iress;

- changes to the Iress Board or significant changes in senior management personnel;

- an undisclosed significant change in Iress' market share;

- likely or actual entry into or termination of a material contract; material acquisitions or sales of assets by Iress; or

- a proposed dividend or other distribution or a change in dividend policy; or a material claim (including a threat of a claim) against Iress or other unexpected liability.

3.4 When is information "generally available"?

Information is generally available if:

a. it consists of readily observable matter or deductions; or

b. it has been brought to the attention of investors through an announcement to the ASX or otherwise similarly brought to the attention of investors who commonly invest in Securities, and a reasonable period has elapsed since it was announced or brought to investors' attention; or

c. it consists of deductions, conclusions or inferences made or drawn from information referred to in paragraphs (a) or (b) above.

Some examples of possible readily observable matters are:

- a change in legislation which will affect Iress' ability to make certain types of investments or offer certain types of products; or

- a severe downturn in global Securities markets.

3.5 What can happen if things go wrong?

A breach of the insider trading laws is serious and may subject you and / or members of your family to:

a. criminal liability, meaning penalties including heavy fines and imprisonment;

b. civil liability, meaning you can be sued by another party or by Iress for any loss suffered as a result of illegal trading activities; and

c. civil penalty provisions, meaning ASIC may seek civil penalties against you and may even seek a court order that you be disqualified from managing a corporation.

Breach of the law or this policy will also be regarded by Iress as serious misconduct which may lead to disciplinary action or dismissal.

4. Restrictions on dealing in Iress Securities under the Iress policy

4.1 No trading at any time where you have inside information

You cannot deal in Iress Securities at any time including outside a Blackout Period if you possess inside information.

4.2 Blackout periods for all employees and directors (and their Associates) of Iress

There are certain times throughout the year that employees, directors and their Associates cannot deal in Iress Securities even if they don’t possess inside information at that time. These are called blackout periods and are around the times that Iress releases its financial results. The blackout periods are the same for all people and are as follows:

a. full year results, being from 15 December to the close of trading on the business day after the day Iress’ annual results are announced to the ASX;

b. half yearly results, being from 15 June to the close of trading on the business day after the day Iress’ half yearly results are announced to the ASX;

c. AGM, being from two weeks prior to the date of Iress’ AGM to the close of trading on the business day after Iress’ AGM; and

d. other times, being any extension to a blackout period, and any additional period, as specified by the Iress Board.

Dealing in Iress Securities during the blackout periods is prohibited except where your dealing is a permitted dealing covered by section 8 of this policy or you satisfy the exceptional circumstances requirements covered by section 7 of this policy.

Directors, senior management personnel and Specified Roles of Iress also need to follow the procedure set out in section 4.3 of this policy if they wish to deal in Iress Securities outside a blackout period.

4.3 Procedure that directors, senior management personnel and Specified Roles of Iress need to follow to be able to deal in Iress Securities

Directors, senior management personnel and Specified Roles (or their Associates) who wish to deal in Iress Securities outside the blackout periods described in section 4.2 of this policy must adhere to the following clearance requirements:

a. Directors (other than the Chair) and their Associates: if a director (other than the Chair) or their Associate wishes to deal in Iress Securities, the director must contact the Chair by email (including a courtesy copy addressed to the Company Secretary) before any dealing occurs.

b. Chair or Chair’s Associate: if the Chair or their Associate wishes to deal in Iress Securities, the Chair must first notify the Chair of the Audit & Risk Committee or, failing the Chair of the Audit & Risk Committee being available, the Company Secretary or the Iress Board before any dealing occurs.

c. Senior management personnel, Specified Roles and their Associates: if senior management personnel, Specified Roles or their Associate wishes to deal in Iress Securities, the senior management personnel or Specified Role must first notify the Managing Director or Chief Financial Officer before any dealing occurs.

In each case, the notification must state that the proposed dealing is not as a result of access to, or the receipt of, inside information, and must specify the number or amount of Iress Securities involved and the proposed time frame.

Acknowledgment of a notification by Iress is intended as a compliance monitoring function only. It is not an endorsement of the proposed dealing. Individuals remain responsible for their own investment decision and their compliance with the law.

Any proposed dealing by a director or other senior management personnel or Specified Role must occur, to the extent possible, within five (5) business days of the date of notification.

5. No short term dealings

All directors and employees of Iress are prohibited from engaging in short term dealings in Iress Securities.

Short term means in less than a three (3) month period. Bona fide transactions associated with employee equity plans (e.g. selling deferred Securities during a trading window after they have been released from restriction or after they have been provided on exercise of a performance right) are exempt from this restriction on short term dealings.

6. No short selling

All directors and employees of Iress are prohibited from short selling Iress Securities, that is sell Iress Securities that have been borrowed with a view to repurchasing them at a lower price and returning them to the lender.

7. Exceptional circumstances

Iress Securities may be dealt with by a director or employee of Iress in exceptional circumstances during a blackout period (e.g. in the potential case of financial hardship), with approval as outlined below.

A request to deal in Iress Securities during a blackout period may be made to the Chair, the Iress Board, the CEO or the Company Secretary. Each case will be based on its own merit, however, you must be able to demonstrate that your circumstances are exceptional and that the dealing in the Securities is the only reasonable course of action.

The request must state that the proposed dealing is not as a result of access to, or the receipt of, inside information. It must specify the number or amount of Iress Securities involved and the proposed timeframe and must also include details of the exceptional circumstances.

The Chair, the Iress Board, the CEO or the Company Secretary will have the ultimate discretion over the request. Any approval granted is valid for that singular request only and must be resubmitted in the event that a further exceptional circumstance is encountered.

8. Permitted dealings

The following types of dealing are excluded from the operation of section 4 of this policy and may be undertaken at any time without requiring prior notification, approval or confirmation of dealing, subject to the insider trading prohibitions:

a. takeover or scheme, meaning undertakings to accept, or the acceptance of, a takeover offer or participation in a scheme of arrangement

b. rights issues, SPPs, DRPs etc., meaning trading under an offer or invitation made to all or most of the shareholders, such as a rights issue, a share purchase plan, a dividend reinvestment plan and an equal access buy-back, where the plan that determines the timing and structure of the offer has been approved by the Iress Board;

c. bonus issue, meaning acquiring Iress Securities under a bonus issue made to all holders of Iress Securities of the same class;

d. employee equity plans, meaning applying to participate in an employee equity plan operated by Iress, receiving Securities as a result of that application (such as deferred Securities, deferred share rights, equity rights or performance rights), the acquisition of Securities as a result of the exercise of rights granted under an Iress employee equity plan, the withdrawal of Securities from the Iress Employee Share Trust to any employee and the sale of Securities by Iress to satisfy tax or other obligations imposed by a Government agency pursuant to any law in any jurisdiction. However, the policy does apply to the subsequent sale of Securities you acquire under an Iress employee equity plan; or

e. disclosure document, meaning subscribing for Iress Securities under a disclosure document such as a prospectus.

9. Margin lending

Senior management personnel must use their best endeavours to ensure they are not put in a position of conflict with this policy by virtue of having margin or other loans over other Securities.

10. Restriction on hedging and use of derivatives

The use of derivatives or any other hedging instrument over Iress equity (including Securities subject to a minimum shareholding requirement, restricted Securities, restricted vested equity rights, unvested performance rights or any other unvested equity) is prohibited and those entering into such schemes will be in breach of the terms and conditions of the grant. As a consequence, the Board will exercise its right to cancel / clawback the hedged unvested or restricted equity. Hedging is any arrangement that reduces economic exposure to an investment, for example purchasing a financial instrument that offsets potential gains or losses from share price movements.

11. Effect of compliance with this policy

Compliance with this policy does not absolve a director or an employee of Iress from complying with the law, which must be the overriding consideration when dealing in Iress Securities.

12. Inside information about other companies

At times you might also have access to inside information about other public companies that Iress has business dealings with.

The Managing Director or Company Secretary will indicate from time to time if any of these companies fall into this category.

The Australian insider trading rules apply to the Securities (or any other Securities) in those companies and therefore you must not buy, sell or otherwise deal in those Securities (or procure or ‘tip' another person to do so) for as long as you possess the inside information.

13. Overview

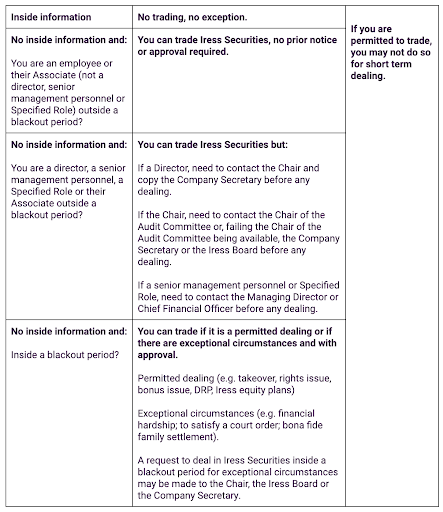

The following table summarises the key points in this policy. You should read it in conjunction with the policy detail.

Dated: 25 January 2024

Iress is a technology company providing software to the financial services industry.