Conflicts of

interest policy

- Home

- Investors

- Governance documents

- Conflicts of interests policy

- Investors

- Calendar

- ASX Announcements

- Results & reports

- Board of Directors

- Share information & registry

- Corporate directory

- AGM

-

Governance documents

- Anti bribery & corruption policy

- Audit & risk committee charter

- Board charter

- Code of ethics & conduct policy

- Conflicts of interests policy

- Disclosure & communication policy

- Diversity policy

- Gender diversity

- Modern slavery act statement

- People & performance committee charter

- Share trading policy

- Whistleblowing policy

- Anti-Fraud and Fraud Awareness Policy

- Supplier Code of Ethics

Iress Limited (incorporated in Australia, ABN 47 060 313 359) and all companies within its Group (together “Iress”) conducts its business according to the principle that it must identify, assess, evaluate and manage (eg control, avoid and disclose) actual, apparent or potential material conflicts of interest, both between itself and its existing or potential clients, and between one client and another.

This document applies to all people working in or for Iress and sets out our policies and procedures governing conflicts of interest.

1. Introduction

A ‘conflict of interest’ is a situation which may prevent products or services being provided in a fair, orderly and transparent manner. Conflicts of interest can arise in a number of circumstances, including between Iress / an employee of Iress / any associate of Iress, and any of its clients; or between two or more of Iress’ clients.

Examples of ‘conflicts of interest’ include situations where Iress, or an employee of Iress, or a person associated with Iress:

a) is likely to make a financial gain, or avoid a financial loss, at the expense of a client;

b) has an interest in the outcome of a product or service provided to a client;

c) has an interest in the outcome of a transaction carried out on behalf of a client;

d) has a financial or other incentive to favour the interest of a client or group of clients over the interests of another client;

e) carries on the same business as a client; and

f) receives, or will receive from a person other than a client, an inducement in relation to a product or service provided to a client, in the form of monies, goods or services, other than the standard commission or fee for that product or service.

2. Personal conflicts of interest

Anyone who believes that they have or might have a personal conflict of interest or who believes that their actions will or might conflict with the contractual, legal or regulatory duties they have to Iress, Iress’ clients or Iress’ suppliers must inform the Managing Director (or equivalent position held) or a member of the Leadership Team (an “Executive”) in the jurisdiction in which they operate, and the Compliance team, without delay and must not thereafter participate in, or in any way seek to influence, any negotiations, discussions or decisions relating to the relevant transaction which is the subject of the conflict without the approval of the Managing Director or Executive, and the Compliance team.

For the above purposes, a personal conflict of interest arises where an employee of Iress (or any connected person of such employee) or a person associated with Iress has or appears to have a personal interest in any transaction.

In relation to this statement:

a) "personal interest" means (whether direct or indirect) any actual, apparent or potential advantage, benefit, gain or profit; a personal interest should be assumed where the transaction involves any company, business or entity or person (including their products and services) in which the employee or connected person has an involvement;

b) "transaction" means any contract, transaction or arrangement to which Iress is party or in which Iress is involved or engaged, or any negotiations or discussions relating to any proposed such contract, transaction or arrangement;

c) "connected person" means a close family relation or business partner; and

d) "involvement" means, in relation to the relevant company, business or entity, any interest in any shares (other than any minor (less than 5%) interest in shares quoted on a recognised stock exchange) or the holding of a directorship or other office or a partnership or any other engagement, relationship or interest of a financial or managerial nature. In relation to a person, it means knowing them in a personal capacity.

Where a personal conflict is identified it must be managed promptly. This may involve the individual removing themselves from dealing with a particular issue, client or supplier, or it may be that the conflict can be managed by disclosure to all parties (in a timely, prominent, specific and meaningful manner) and close monitoring. Each occurrence will need to be judged on its own merits.

3. A conflict between Iress and its client

Anyone who believes that there is or might be a conflict between the interests of Iress and one of its clients or who believes that Iress’ actions will or might conflict with the contractual, legal or regulatory duties Iress has to its clients must inform an Executive and the Compliance team without delay.

For the above purposes, a conflict of interest arises between Iress and its client where there is a conflict between the interests of Iress and the contractual, legal or regulatory obligations that it owes to its client.

In relation to this statement:

a) “interests of Iress” means that financial benefit, interest or gain would be achieved to the detriment of the business interests of the client.

b) “business interests” means any business interests of the client whether directly related or not to their contracts, arrangements or dealings with Iress.

4. A conflict between two or more of Iress clients

A conflict may also arise where Iress becomes aware of confidential or sensitive information through dealings with clients that could be of use when negotiating contracts with other organisations. If this should occur the employee concerned (or person associated with Iress) must inform an Executive and the Compliance team without delay. The Executive and the Compliance team may decide that the confidential or sensitive information, or the existence of it, should be declared to the relevant client and remove the employee or person associated with Iress from the negotiations (if and where appropriate) to ensure there can be no accusations of dishonest practice. It may be possible to manage minor conflicts as long as they are disclosed to all parties (in a timely, prominent, specific and meaningful manner) and monitored at regular intervals. Conflicts of interest may be unavoidable, however it is vital to the interests of Iress that when they occur they are identified promptly and action is taken to ensure that the conflict is managed appropriately.

5. Reporting a conflict

When reporting a conflict, the following procedure should be followed:

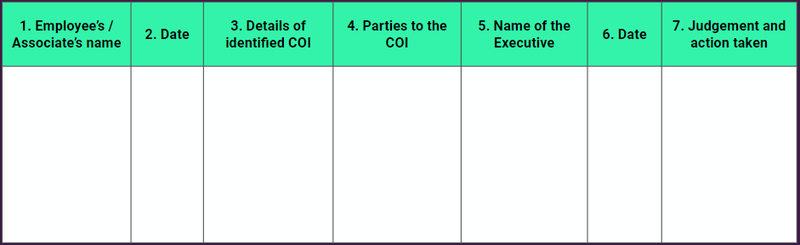

a) The employee or person associated with Iress must complete the first 4 columns of the attached ‘Conflicts of Interest Report’ (the “Report”), (see Appendix 1), and forward the Report to an Executive in the jurisdiction in which they operate, copying in a member of the Compliance team.

b) The Executive receiving the Report must consider the details of the conflict of interest, and may wish to liaise with the employee (or their People Leader) or person associated with Iress reporting the conflict to further understand the situation.

c) The Executive receiving the Report must then complete columns 5 - 7 and forward the completed Report to the Compliance team.

d) The Compliance team will add the details to the ‘Conflicts of Interest Register’, forwarding an up to date copy of the register to the Audit and Risk Committee of Iress Limited on a quarterly basis.

e) Employees reporting breaches of the Conflicts of Interest Policy to the Compliance Team are protected under the Whistleblower Policy.

f) The conflicts of interest arrangements covered here—and this policy in general—are:

- a) reviewed internally on an annual basis and, where deemed necessary, updated to ensure that the arrangements continue to be adequate in identifying, assessing, and evaluating and successfully controlling conflicts of interest;

- b) overseen by a specific and appropriately qualified person or persons who take responsibility for their implementation, reviewing and updating; and

- c) included in regular training for Iress representatives (inclusive of those appointed as Responsible Managers), to ensure they continue to have the necessary knowledge and skills to perform their existing roles and functions.

6. Record-keeping

Board and Committees

A standing agenda item at Iress Limited Board meetings requires the Board to consider, and the Minutes of the meeting to record, any conflict of interest arising for a Director, including the type of conflict and how the conflict was managed by the Board.

AFS Licensees

In addition, all Australian Financial Services Licensees are required to maintain records for at least 7 years of:

a) conflicts identified;

b) actions taken;

c) reports about conflicts of interest matters; and

d) disclosures given to clients or the public as a whole.

Appendix 1

Conflicts of Interest (‘COI’) Report

Iress is a technology company providing software to the financial services industry.